Meaning of Ten:34 Getting from Here to There Our Approach Our Experience Set Why We’re Different

We are often asked why the name Ten:34 Partners. It reflects our admiration and respect for small business owners. Here’s the backstory.

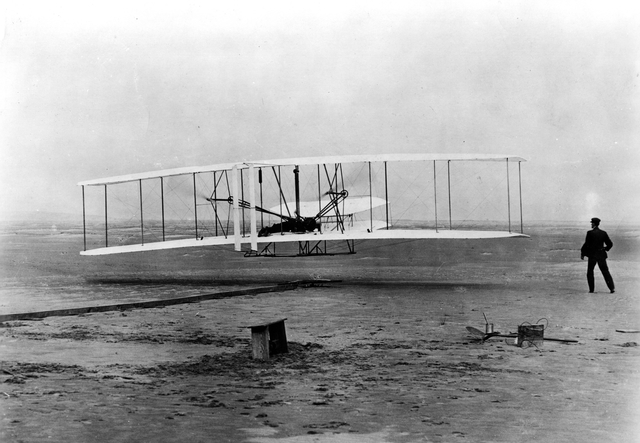

At 10:35 a.m. on December 17, 1903, the Wright Brothers successfully conquered flight at Kitty Hawk. This was not the culmination of their careers but another tipping point in a series of small business successes that began in 1890 when Wilbur joined Orville in his printing business. Next, in 1894, to supplement their income, the Wright brothers opened a bicycle shop to repair and sell bicycles. They pivoted again in 1896 and began making their own bicycles. It was around this time that their entrepreneurial drive turned to aviation and led to the 1903 flight.

Imagine if you were Orville or Wilbur at Ten:34 a.m., a minute before take-off, what might you have been thinking? Picture Orville about ready to take flight: was he concerned about the risk or excited about the possibilities? Was Wilbur concerned for his brother’s health or focused on learning from this next attempt at achieving their goal?

Most business owners we know can relate to these emotions and challenges, and to us, this story is a metaphor for the many business owners we know. They’re motivated, focused and passionate about their business. They are inspired by what may be and are looking for ways to take that next step.

Ten:34 Partners may be a key to helping your business take that next step. The Wright Brothers found the key to flight by adding the mechanic, Charlie Taylor, to the team. He had the skillset to build an engine that was light enough and powerful enough to allow flight to happen. Might Ten:34 be your Charlie Taylor — supplementing your business acumen with our skillset to get to that next point in accomplishing your objectives?

Business owners are short on resources. They are focused on day-to-day operations and customers. It’s not easy to find the time and know-how to realize your vision. And, it’s not easy to find that right investment partner who will internalize your vision as their own. We will only partner with a business if there is strong alignment between your vision for the business and our vision. With that as the base, much can be accomplished as we provide the extra resources and committed experts that you need. We’d love to get to know you and for you to get to know us to see if we are the right partners for each other.

Who knows, but we sure hope we can be what you need. Only time will tell. Here’s our thought process on whether a partnership with us makes sense:

There will always be similarities and differences in viewpoint. The key is whether we’re getting to the answers that you and Ten:34 feel good about when we work together. If so, that’s a good basis for a strong partnership. What’s important to you in selecting a partner? Let’s talk about it.

Typical Private Equity Firm

Typical funds expect payback in 3-5 years, creating extreme pressure and short-term decision-making

Ten 34 Approach

Utilize patient, nimble capital focused on long-term decision-making and steady growth

Typical Private Equity Firm

A diversified portfolio creates initial focus then attention to portfolio companies only when problems arise

Ten 34 Approach

Invest in a select number of businesses (3-5 typically) so you and your company will always be our focus

Typical Private Equity Firm

Responsibilities are divided between a sales team, execution team, and monitoring team

Ten 34 Approach

Ken and Justin are the sales, execution, and monitoring team and are available at all times; we’re focused on collaboration — not command and control

Typical Private Equity Firm

Executives are encouraged to work together but only incentivized to focus on their business

Ten 34 Approach

We create a holding company structure and grant equity interests to key executives providing economic opportunity in all Ten:34 holdings

© Copyright 2024 Ten:34 Partners. All rights reserved. | Sitemap